Tariffs: To outsmart or fall in line?

Tariffs: To outsmart or fall in line?

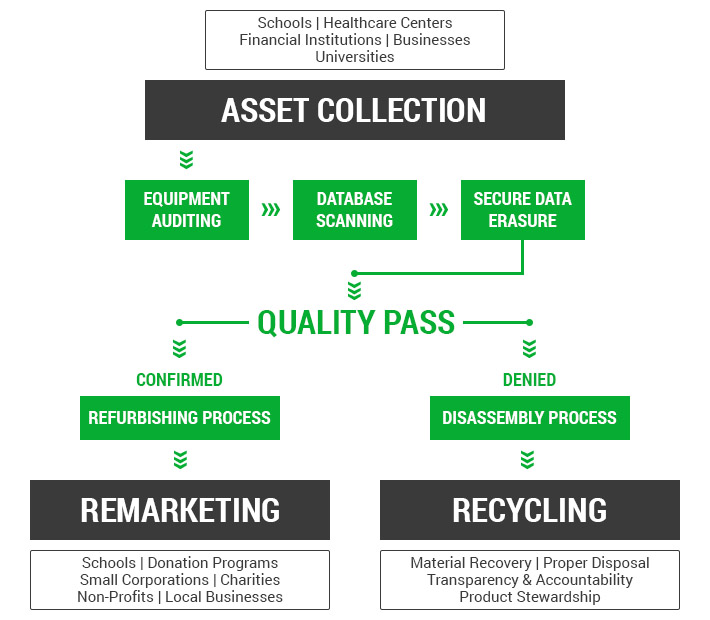

Tariffs have been in the news a lot over the past two years, and working in an industry like IT asset disposition, where goods and services are traded worldwide, I often hear from clients and customers interested in this subject. I tell them there are pros and cons every business leader should understand. After all, for any company buying and selling on a global scale, whether their business is IT or soybeans, tariffs are just business as usual.

So what are tariffs? I’ll leave that to CNBC’s Uptin Saiidi (https://www.youtube.com/watch?v=LKCMnCZyxiQ), who does a great job explaining how national fees on imports and exports control trade deficits globally.

Tariffs are a game-changer in many fields, and they certainly are in mine. I see firsthand how some countries find ways around taxes, which causes tariffs to surge. In other countries, this isn’t the case. Just look at the United Arab Emirates: it’s effectively a trade-free zone. The market for IT products in the UAE is amazing, and much of the business it draws comes from surrounding countries.

Who is affected most by tariffs? I can only speak for my client/customer base, but I’m hearing increasing frustration from Canadian clients, who will be facing a steep tariff of 25 percent starting in 2019.

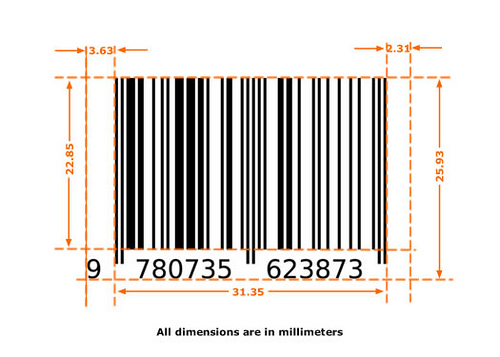

I’m often asked what products are affected by tariffs. Here’s a pretty encompassing list by the U.S. government’s federal trade representative: https://ustr.gov/sites/default/files/enforcement/301Investigations/Tariff%20List_09.17.18.pdf. Every product that’s imported or exported in the U.S. is assigned a code by the federal government called a Harmonized Tariff Schedule, known as an HTS code or HTS number. This 10-digit code is specific to the United States and administered by the U.S. International Trade Commission.

I’m no expert, but I will say that when considering tariffs, plan for items with very high margins to be able to absorb the costs. Goods that can be sourced outside tariffs at a very low cost will see small cost increases. Overall, prices will increase on certain items if the market can stand price increases. Sadly, there will be items and opportunities items that will have to be abandoned.

When the price of cheap imports goes up, we can raise prices accordingly, though the cost of goods stays pretty much the same. For example, let’s say that a used Dell AC adapter/charger costs about $10, while a brand-new off-brand one from China costs $8. If China has to raise its price of the new adapter to $12, then we in the States can charge $14 for the used brand-name one. (Keep in mind supply and demand also factor into these equations.)

My experience tells me tariffs will affect the economy in a few of the usual ways:

- Not everyone will be affected.

- Everyone affected won’t be affected equally.

- There will be winners and losers (like every other economic activity).

- No one will successfully predict those winners and losers.

- None of those winners and losers will be honest it.

Phil Biundo At Filmar.com I Buy Sell End of Life Corporate IT Assets is an expert on the secondary market of IT products. Specialties include used and off-lease refurbished computer products, laptops, computers, LED LCD TVs, digital cameras, electronics, unlocked phones, tablets and enterprise IT equipment.

These are my observations an my opinions but I would love to hear more about your frustrations with tariffs and how you plan to overcome them.

LEAVE A COMMENT